It’s no secret that the finance sector is a lucrative one, but is finance a good career path? Well, for starters, it’s so in-demand that you’ll inevitably stumble across multiple TikToks in a day trying to convince you to pursue finance in one way or another (sometimes through very shady means).

We’re here to give you the full breakdown of whether finance is a career you ought to pursue (and we promise that you won’t have to buy our ‘book’ or bottle of supplements for this).

For most students who’re still in school — or are just graduating — finance is not the first option that comes to mind. We don’t think about upskilling and professional development at that age! In fact, most of us just wanted to jump right into whatever gives us the most joy and let’s be honest, finance as a career isn’t particularly entertaining.

But hey, don’t knock it till you’ve tried it, we say! Sure, it might not end up being your ‘thing’ but finance is actually not nearly as boring as most folks think it is; and the remuneration sure does pay off.

We spoke to Creditsafe COO Matthew Debbage, who has over a decade’s experience in business intelligence and company credit management solutions, to determine his thoughts on finance as a career path.

He put it succinctly: “Determining whether finance is a good career to get into or not is entirely dependent on your own personal values. If you’re someone who is interested in a field that provides high salaries and career progression, then finance is an excellent industry.”

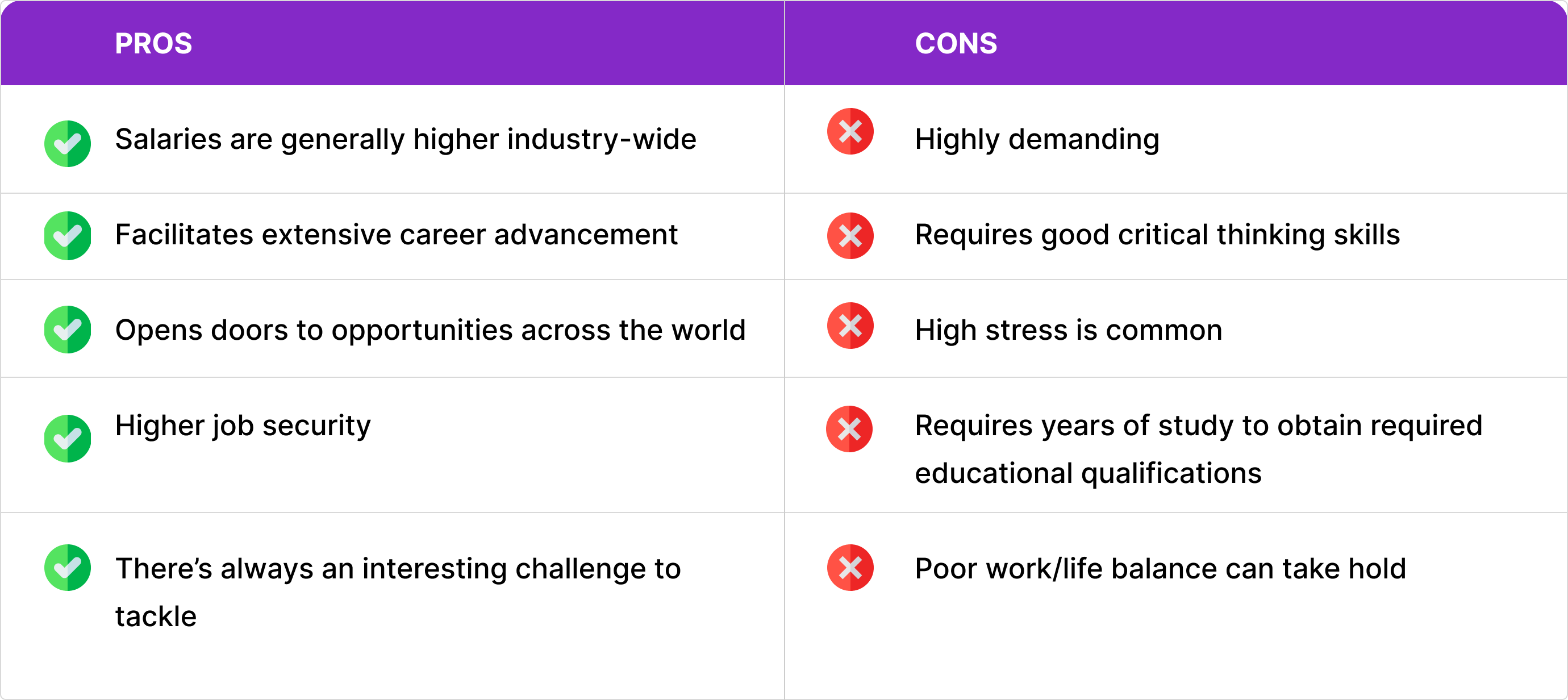

Of course, the best way to decide is to put the pros and cons down and paper to see if it’s worth it!

Let’s start with the benefits.

Salaries

Let’s start with the most exciting thing about finance jobs: the money. Like we said before, it’s no secret that finance jobs pay quite well — regardless of your role. A five-figure salary on the higher end is of course assured in the sector, but you can easily make six figures if you plot your career path accordingly.

Regardless, your chance of making and taking home an above-average compensation for your work is guaranteed. So, if making a lot of money is your goal, a finance job is a surefire way to reach it.

Career advancement

If you’re looking to grow and reach higher skies in your career, then finance remains a good option. From investment bankers to portfolio managers, the sector will always have demand for finance professionals, and as new businesses crop up, this demand only grows higher, along with opportunities to build your skills and experience until you’re ready to climb higher up the corporate ladder.

And the best part? This also means that you’ll be able to enjoy more job security. The more integrated you get with the field — and particularly, a company — the higher your chances of retaining your position. Finance has a relatively low employee turnover rate compared to industries like hospitality, too, sitting at a comfortable 28.5% as of 2021. So, that’s something to consider seriously.

Additionally, finance offers clear career progression routes and is a lot less convoluted than most other fields, including those in STEM, making it a breeze to plot your course and make your next move quickly. Of course, keep in mind that smaller businesses will offer you shorter roads.

Global opportunities

Some people love living where they live, while others want to traverse the world. Finance opens doors to you that would otherwise be sealed shut to many. You’ll have countless global opportunities to explore at your leisure if you’re considering moving to a different country. This is only furthered by the fact that finance provides a lot of good networking opportunities, too, which will only further expand your reach.

The only issue here would be the nature of your specialization and the demand for that specific qualification in a particular country, so best do you research now if you have long-term plans to relocate in mind.

Challenges

If you’re somebody who dislikes cut-and-dry tasks, this might be a good reason to explore finance.

It’s notoriously one of the most challenging sectors, putting you in new scenarios often and presenting you with a fresh puzzle to solve.

If you’re up for a challenge, then finance will keep you on your toes. This spawns from the fact that it’s a forward-thinking field. New technologies are conceptualized and implemented for the sole purpose of furthering the industry so often that you might miss a whole tech evolutionary cycle if you blink too long. Best keep in mind that it’s a fast-paced industry to be in, so if you’re looking to chill and sit back, it’s not going to work for you.

So, now we know the key benefits of pursuing finance as a career path, but what about the negatives?

Demanding

You snooze, you lose. This is actually quite literal in finance. Remember when we talked about it being challenging? Well, those challenges will demand a lot from you. You need to be able to think critically on your feet while analyzing and flitting across tasks. Additionally, you’re required to have good proficiency in mathematics because … well, finance involves a lot of numbers. And believe us when we say, it can get complex.

If numbers don’t scare you and you’re confident in your problem-solving skills, then go ahead. If not, you might want to take a step back and reevaluate.

High stress

Coming as a surprise to no one at all, finance is STRESSFUL. Its heavy workloads, cyclical nature and rapid pace will make a softer person tear their own hair out. You have to have your eye on every little detail all the time, and letting anything slip (depending on your specific job role) could easily cost the company a fortune and you, your career.

Unlike in creative fields of work, finance doesn’t offer you an outlet to experiment and have fun with it, so staying motivated and managing your stress levels on the job will present a hurdle. You’ll need to find time for yourself outside of work to handle these issues or you’ll find yourself lapsing under the weight of it all.

Qualifications

Everything about finance is fast-paced, except getting qualified for it, which is a tedious and lengthy process. You’ll have to put a good several years into your educational qualifications before you’re ready to enter the world of finance.

If you want to really take advantage of career progression in the financial world, you’ll have to equip yourself with not just a Bachelor’s, but also a Master’s degree or its post-graduate equivalent (like CIMA) to make you seem more appealing to employers. Additionally, you’ll also have to pile on other qualifications and in the case of some job roles, like that of financial managers, licences.

If you think it stops there, you’re wrong. A highly in-demand, well-paying industry like this wants to retain only the best and most proficient. Therefore, those in the industry have to keep upskilling and learning quickly (and a lot) to stay abreast of their peers or risk being left behind.

Work/life balance

It’s common for finance professionals to have a poor work-life balance, often working 50-70 hours a week, and in some cases (like investment banking), even 100 hours a week. For many in the industry, it isn’t uncommon to work the weekends. This isn’t a set rule, though, and it would be disingenuous to claim otherwise, but it is COMMON.

The long hours and the stolen weekends may take a toll on those who prefer having time to spend with themselves or with their families.

Table 1

Final thoughts

Now that we’ve run through the main pros and cons of pursuing a career in finance, it’s also important to note that your early years in any industry will be a struggle. You’ll need time to establish yourself and learn the ropes before you can reach new heights in your career.

An entry-level job in finance will be the same, and most of the points we’ve listed here apply greatly to those in the early stages. Circumstances can change, and with it, maybe your luck will too (hopefully for the better), so don’t let that be the sole deciding factor.

Take some time to properly list out and analyze the pros and cons. Highlight three priorities you wish for your career and pit this list against them. See if the benefits outweigh the negatives enough for you to invest your time, money and effort into building a finance career.

If you’re just starting out and want to learn more about navigating the early career space like a pro, we highly recommend you check out our blog and social media. We’ve got tons of free tips and resources to help you get started.